Other - ERTC

Accuracy. Assurance. Confidence.

- Home

- Others- ERTC

Built on Accuracy

ERTC Advisory Support

Our ERTC services help businesses navigate complex credit programs with clarity and confidence. We assist in identifying eligibility, analyzing qualified wages, and preparing accurate documentation to ensure compliance and audit readiness. Through a structured, process-driven approach, we minimize risk while delivering reliable and transparent support.

Program Overview

What is Employee Retention Tax Credit?(ERTC)

The Employee Retention Tax Credit (ERTC) is a refundable payroll tax credit designed to support businesses that retained employees during periods of operational disruption or financial hardship. Eligible organizations can claim credits on qualified wages and certain health plan expenses, helping improve cash flow and financial stability.

ERTC is not a loan and does not require repayment. When claimed correctly, it provides direct financial relief through payroll tax refunds.

Eligibility Check

Are You Eligible For The ERTC?

Your business may qualify if it experienced any one of the following:

-

Operational Disruption Full or partial suspension of operations due to government-mandated restrictions.

-

Revenue Decline A significant reduction in gross receipts when compared to a prior benchmark period.

-

Recovery Startup Status New businesses that began operations after a defined start date and meet revenue thresholds.

New businesses that began operations after a defined start date and meet revenue thresholds.

How Will The Process Work?

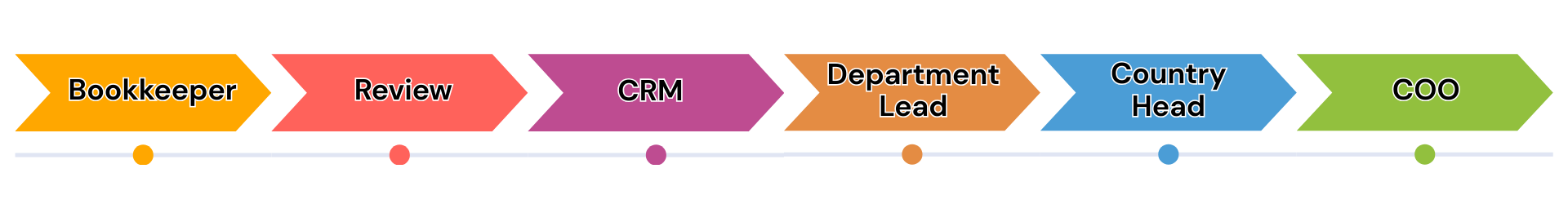

Navigating the ERTC Claim Process

We follow a structured, step-by-step approach to evaluate eligibility, gather required data, calculate credits, and submit accurate claims—ensuring compliance, transparency, and a smooth end-to-end ERTC process.

Why Us?

What Sets Us Apart

-

Program Expertise OfferingIn-depth understanding of ERTC requirements and evolving guidelines. scalable solutions to streamline financial management and ensure compliance.

-

Structured Methodology Process-driven approach ensuring accuracy and consistency.

-

Compliance-Focused Thorough documentation to support audit readiness and validation.

-

Risk-Controlled Execution Careful review to minimize errors and reduce exposure.

-

End-to-End Support From eligibility evaluation to claim submission and follow-up.

Meet Our Expert

Know Your Team

Ensuring Accuracy

Thorough Review Process

Before final delivery, every ERTC engagement undergoes a rigorous review process. A dedicated review layer ensures calculations, documentation, and compliance checks are complete and accurate, maintaining high quality and consistency.

BYOT: Engagement Model

Flexible & Scalable Solutions

We prioritize data security, implementing advanced encryption and multi-factor authentication to protect your sensitive financial data. Our protocols ensure that your information is safe from unauthorized access, providing you with peace of mind and maintaining trust in our services.

Frequently Asked Questions

Clear and Simple Answers to Your Queries

ERTC is a refundable payroll tax credit created to support eligible businesses by offsetting qualified employee wage costs during eligible periods.

Businesses that experienced operational disruptions or a decline in gross receipts during eligible periods may qualify, subject to specific criteria.

Qualified wages generally include employee compensation and certain employer-paid health insurance costs, depending on eligibility and time period.

Processing timelines vary based on documentation, claim complexity, and review requirements. Our team ensures timely and accurate submission to avoid delays.

Yes, eligible businesses may claim ERTC retroactively by filing adjusted payroll tax forms within the allowable time frame.

Get Started Today

At Accountsease Solutions, we make managing your finances easy. You focus on growing your business—we’ll take care of the numbers.